Homeowners’ Associations (HOAs) have a lot of power over communities, but can they actually evict you from your own home? If you’re facing disputes with your HOA or worried about losing your property, knowing your rights is essential. While HOAs enforce community rules and collect fees, their authority has limits, especially when it comes to removing a homeowner from their property.

This article will break down the legal side of HOA evictions, the difference between eviction and foreclosure, and how you can protect yourself if an HOA takes legal action against you.

Table of Contents

Can an HOA Legally Evict a Homeowner?

No, an HOA cannot directly evict a homeowner. Eviction is a legal process used to remove tenants from rental properties, not homeowners. However, while an HOA cannot evict a homeowner, it can take legal actions such as placing a lien or initiating foreclosure if dues or assessments remain unpaid. This could ultimately lead to the homeowner losing their property.

How HOAs Can Take Legal Action

While an HOA cannot simply remove you from your home, they can enforce rules and collect dues. If you fail to comply, they may:

- Fine you for violations of HOA rules.

- Place a lien on your home if you don’t pay assessments or fines.

- Initiate foreclosure proceedings if unpaid liens accumulate.

In extreme cases, if a homeowner’s behavior violates community rules (e.g., illegal activity, extreme negligence), an HOA may work with local authorities to have the homeowner legally removed.

Reasons Why an HOA Might Try to Remove a Homeowner

Homeowners typically face legal action from their HOA for the following reasons:

Unpaid HOA Dues or Special Assessments

Most HOAs charge monthly or annual fees to maintain the community, along with occasional special assessments for major repairs or improvements. If a homeowner falls behind on payments, they may face late fees, interest, and eventually a lien on their property.

In extreme cases, prolonged nonpayment, including failure to pay special assessments, can lead to foreclosure.

Violating Community Rules

HOAs enforce bylaws that cover everything from landscaping to parking. Repeated violations can result in fines, legal action, or even court-ordered compliance. While rare, severe or ongoing infractions may escalate to more serious consequences.

Property Neglect or Safety Violations

If a home falls into disrepair or poses a safety risk, the HOA may intervene. Structural violations, unsafe conditions, or failure to meet community standards could lead to enforcement actions, including legal proceedings to compel compliance.

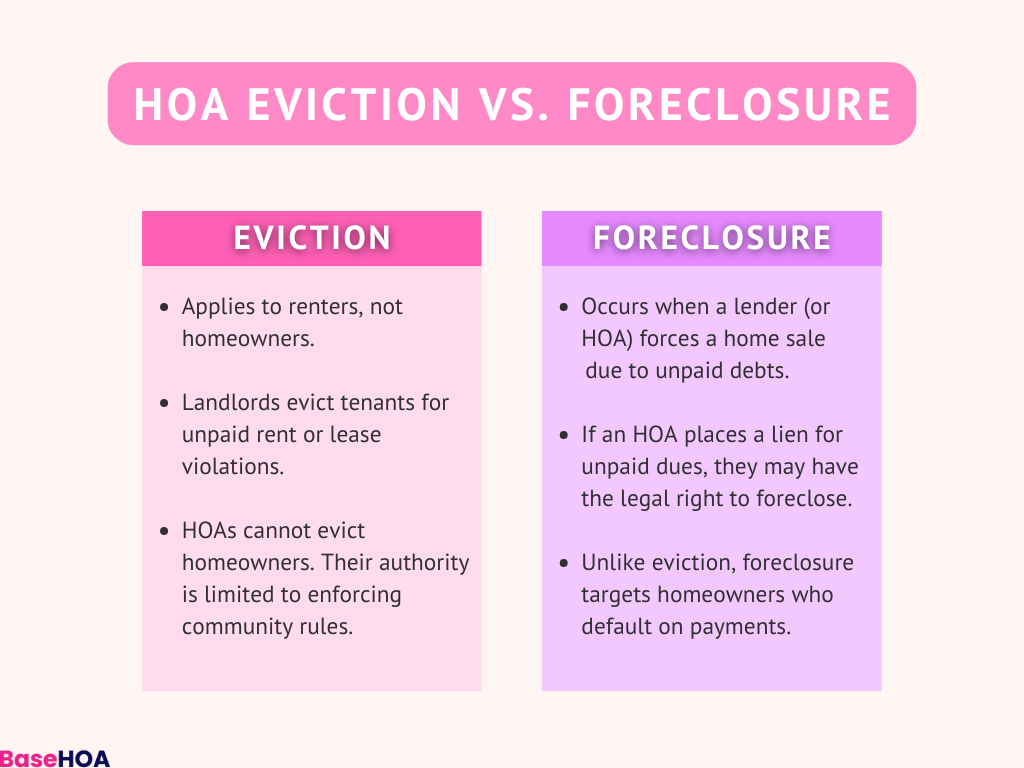

HOA Eviction vs. Foreclosure: What’s the Difference?

Many homeowners mistakenly believe eviction and foreclosure are the same, but they are two distinct legal processes:

Eviction: Used by landlords to remove renters who fail to pay rent or violate lease terms. Homeowners cannot be evicted in this way.

Foreclosure: A legal process where a lender or lienholder (such as an HOA) forces the sale of a home due to unpaid debts. HOAs can foreclose if they have placed a lien on a property for unpaid dues.

How an HOA Foreclosure Works

1. The HOA Files a Lien

If you fail to pay your HOA dues, fines, or special assessments, the HOA has the legal right to file a lien against your property. This lien acts as a claim on your home, which means the HOA has a financial interest in the property until the debt is paid off.

A recent study from the Lincoln Institute of Land Policy highlights how HOA delinquency rates can impact property values, potentially costing homeowners 1.5% less in property value. This can make it even harder for homeowners to recover financially from unpaid dues or assessments.

2. Legal Notice is Sent

Once the lien is in place, the HOA will send you a formal notice of default. This notice informs you of the unpaid debts and warns that foreclosure proceedings may begin if the debt is not resolved within a specified period.

3. Foreclosure Process Begins

If the debt remains unpaid after the notice period, the HOA can file a foreclosure lawsuit. This marks the official start of the legal foreclosure process, allowing the HOA to seek a court order for the sale of your property to recover the unpaid dues.

4. Court Ruling and Auction

If the court rules in favor of the HOA, the next step is the auction or sale of your home. The property is sold at public auction to the highest bidder, and the proceeds are used to pay off the outstanding debt.

If the sale price exceeds the debt, the excess may be returned to the homeowner. If the sale doesn’t cover the entire debt, the HOA may continue to pursue additional payments.

5. Potential for Redemption or Payment Plans

Depending on your state’s laws, you may have a period of time to redeem your property, often by paying the outstanding amount in full plus additional legal fees. Some HOAs may also work with homeowners to establish a payment plan or negotiate the debt to prevent foreclosure.

Homeowner Rights: What You Can Do If HOA Threatens Eviction

If you receive a notice from your HOA about unpaid dues, fines, or violations, here’s how you can protect yourself:

1. Know Your State’s Laws

HOA powers vary significantly by state. Some states, like Florida, allow aggressive HOA foreclosure actions, while others have stronger protections for homeowners.

It’s important to research your state’s HOA foreclosure laws and any required grace periods. Knowing these details will help you understand the timeframe and legal options available to you.

2. Dispute Unfair Charges

If you believe an HOA fee, fine, or assessment is unreasonable or incorrect, you have the right to challenge it. Dispute the charges in writing and request a formal hearing with the HOA board.

Be sure to keep thorough records of all communications, including emails, letters, and payment receipts, as these will be important if you need to take further action.

3. Negotiate a Payment Plan

If you owe dues to the HOA, many associations are open to negotiating a payment plan to help you avoid foreclosure. It’s worth contacting the HOA to discuss your financial situation and explore options for settling the debt over time.

Additionally, some states require HOAs to offer mediation before pursuing legal action, which can help both parties reach a resolution outside of court.

4. Seek Legal Help

If your HOA is threatening foreclosure, it’s a good idea to consult with a real estate attorney who specializes in HOA disputes. An attorney can help you understand your rights and guide you through the process.

Many legal aid organizations also offer free or low-cost consultations, which may be especially helpful if you’re concerned about legal costs.

How to Stop an HOA from Foreclosing on Your Home

If your HOA has filed a lien, it’s not too late and you still have several options:

1. Apply for HOA Debt Relief Programs

In some states, there are specific homeowner relief programs that assist with HOA-related foreclosures. These programs can help you pay off past due fees, fines, or assessments, and may also offer financial assistance to prevent foreclosure.

Be sure to research available programs in your area and apply as soon as possible to take advantage of these resources.

2. Pay Off the Lien

The fastest way to stop foreclosure is to pay off the outstanding debt, including any late fees, interest, and fines. Once the lien is satisfied, the HOA must release it, which can prevent the foreclosure process from continuing.

While this might be the most direct solution, it’s important to ensure that you are paying the correct amount and request documentation of payment for your records.

3. Request Mediation or Arbitration

Many states require HOAs to offer mediation or arbitration before taking further legal action, such as foreclosure. These methods provide a neutral third party to help you and the HOA come to a resolution without the need for a lengthy court battle.

Mediation can be a cost-effective way to resolve the issue, and in some cases, it may help you secure more favorable terms or a more manageable payment plan.

4. File a Legal Challenge

If you believe the HOA violated any legal procedures, you may have grounds to challenge the foreclosure in court. For example, if the HOA didn’t properly follow the required steps for placing a lien or did not notify you of the debt within the required time frame, you may be able to stop the foreclosure.

Filing a legal challenge can be a complex and costly process, but in some cases, it can help prevent foreclosure or delay the process long enough to allow for other solutions.

5. Consult a Real Estate Attorney

If your HOA is threatening foreclosure, it’s crucial to seek legal advice from a real estate attorney who specializes in HOA disputes. They can help you understand your options, assess whether any legal errors were made, and provide guidance on how to protect your home.

Many attorneys offer free consultations, and some legal aid organizations can assist with low-cost or pro-bono services if you qualify.

6. Explore Loan Modification Options

If your financial situation has changed, consider speaking to a financial advisor or lender about loan modification options. Some lenders may allow you to refinance or modify your mortgage to free up money for paying off HOA dues, preventing foreclosure on both the mortgage and the HOA lien.

State-Specific HOA Laws: How They Vary

HOA laws differ across states, affecting how and when an HOA can take legal action. Here are some examples:

- Florida: HOAs can move forward with foreclosure if dues remain unpaid for 90 days or more, giving them strong authority over delinquent payments.

- Texas: Homeowners must receive at least 60 days’ notice before an HOA can initiate foreclosure, providing a grace period to resolve outstanding issues.

- California: Homeowners are entitled to dispute liens in small claims court before foreclosure can proceed, offering an additional layer of protection for property owners.

If you’re unsure about your state’s specific regulations, it’s a good idea to consult your state’s official website or speak with a real estate attorney to understand your rights.

FAQs About HOA Evictions

Can an HOA evict me if I fully own my home?

No, but they can place a lien and foreclose on your home if you fail to pay required dues or fines.

What happens if I ignore HOA rules?

You may face fines, legal action, and potential liens on your property.

Can I sue my HOA for harassment?

Yes, if your HOA is unfairly targeting you, you can take legal action for harassment or discrimination.

Know Your Rights & Take Action

HOAs play an important role in maintaining communities, but they cannot directly evict homeowners. However, through liens and foreclosure, they may force a homeowner out if debts go unpaid. Knowing your rights, state laws, and legal options can help you protect your home and fight unfair HOA actions.

If you’re dealing with HOA disputes or foreclosure threats, consulting a real estate attorney is a smart step. Protecting your home starts with knowing your rights.

For HOA boards looking to streamline management and reduce disputes, BaseHOA provides powerful tools to improve communication, financial management, and community engagement. Whether you’re looking to simplify billing, track payments, or enhance transparency, BaseHOA can help.

Start your free trial now and experience how BaseHOA can make a difference in your community’s management!