Homeowners Associations (HOAs) help maintain shared spaces, enforce community rules, and protect property values. But when homeowners fall behind on their HOA dues, the association has the legal right to place a lien on their property.

An HOA lien can have serious consequences. It can impact property ownership, lower credit scores, and even lead to foreclosure. So, what exactly is an HOA lien? How does it work? And what can homeowners and HOAs do to prevent or resolve these issues?

This guide covers everything you need to know, helping both homeowners and HOA boards navigate the process with confidence.

Table of Contents

What is an HOA Lien?

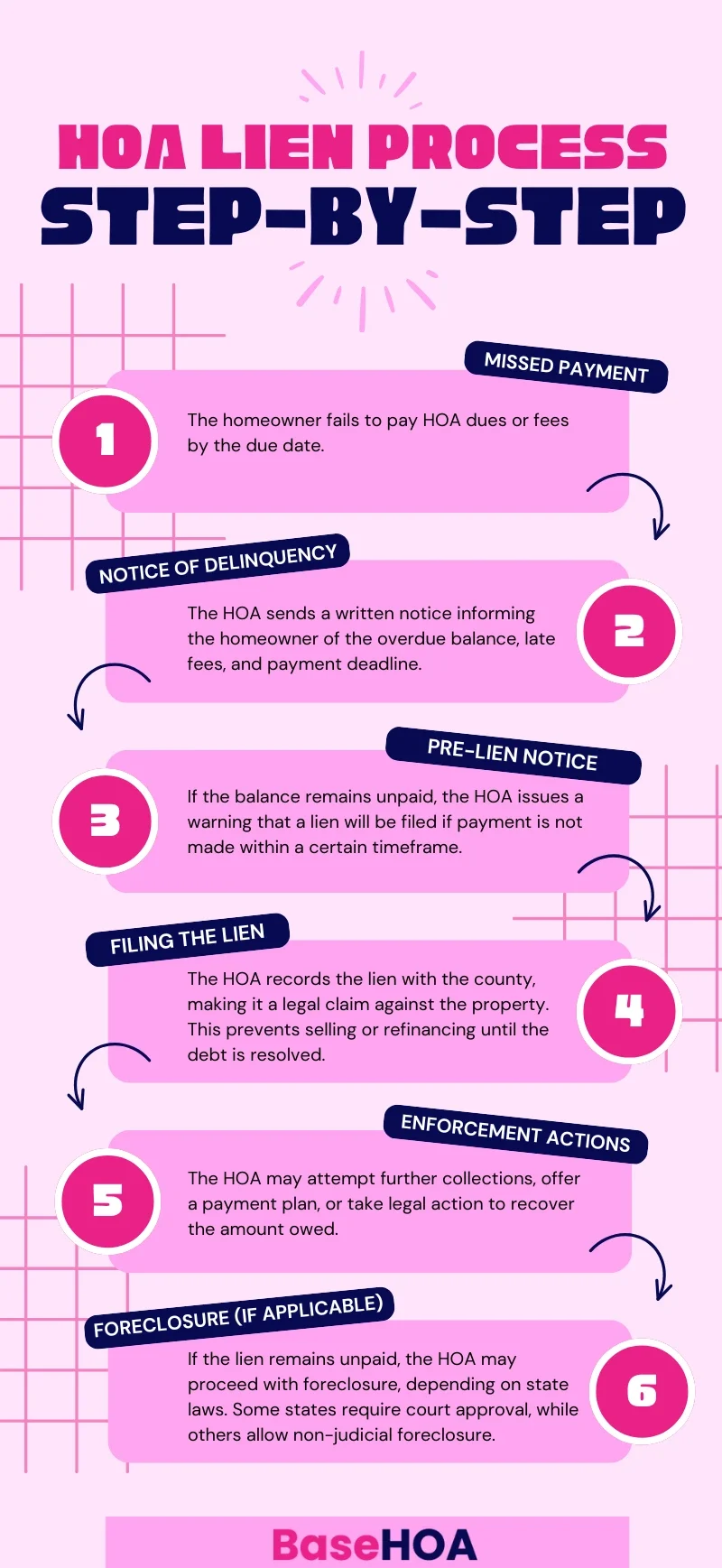

An HOA lien is a legal claim placed on a homeowner’s property when they fail to pay their dues, assessments, or fines. It gives the HOA the right to collect what is owed before the homeowner can sell or refinance the property.

Why Do HOAs Place Liens?

- Unpaid HOA Dues & Assessments – Regular payments fund community upkeep, such as landscaping, security, and amenities.

- Fines for Rule Violations – If a homeowner repeatedly violates HOA rules (e.g., failing to maintain their property), fines may accumulate and lead to a lien.

- Special Assessments – If unexpected expenses arise (e.g., major repairs to community infrastructure), HOAs may charge special assessments, which, if unpaid, result in liens.

A lien helps protect the HOA’s financial stability by preventing unpaid dues from causing budget shortfalls that impact the entire community. If not resolved, it can escalate to foreclosure, putting the homeowner at risk of losing their property.

How HOA Liens Affect Homeowners & HOAs

Impact on Homeowners

An HOA lien can create serious challenges for homeowners. It prevents them from selling or refinancing their property until the debt is settled. In some states, HOAs can report liens to credit agencies, which may lower a homeowner’s credit score and make it harder to secure loans. If the lien remains unpaid for too long, the HOA may even have the legal right to foreclose on the property, putting homeownership at risk.

Impact on HOAs

For HOAs, unpaid dues can strain the association’s budget, making it harder to maintain essential services like landscaping, security, HOA insurance, and repairs. If a lien is not filed correctly, homeowners may challenge it in court, leading to costly legal disputes. Strict lien enforcement can also create tension between HOA boards and homeowners, potentially harming community relationships and trust.

How Long Does an HOA Lien Stay on a Credit Report?

If reported to credit bureaus, an HOA lien can stay on a homeowner’s credit report for up to seven years, making it more difficult to qualify for loans or new credit. However, not all HOA liens appear on credit reports. It depends on state laws and whether the HOA chooses to report the debt.

Legal Rights, Obligations & State-Specific Differences

HOA lien laws vary by state, making it essential for both homeowners and associations to understand their legal rights and responsibilities. These regulations are often outlined in state statutes and HOA bylaws, which govern how liens can be enforced, reported to credit bureaus, or lead to foreclosure.

Homeowner Rights

Homeowners have legal protections when dealing with HOA liens. They must receive proper notice before a lien is placed and have the right to challenge an unfair lien if it includes unlawful fees or was filed incorrectly. Some states also provide additional safeguards, such as redemption periods after foreclosure, giving homeowners a chance to reclaim their property.

HOA Responsibilities

HOAs must follow strict legal procedures when filing liens, including proper notices and timelines. In some states, foreclosure on an HOA lien requires court approval to protect homeowners from unfair enforcement. To avoid legal disputes, HOAs should ensure their lien process fully complies with state laws.

State-Specific Regulations

Since HOA lien regulations differ by location, homeowners and HOA boards should review their state’s laws to ensure compliance and avoid legal disputes. Below are key legal resources for specific states:

- California: Civil Code Section 5660 requires a 30-day pre-lien notice before recording a lien.

- Florida: Florida Statutes, Chapter 720, Section 3085 explains how HOAs can place and enforce liens on properties. HOA foreclosure can occur only after 45 days of nonpayment.

- Texas: The Texas State Law Library provides a detailed guide on HOA assessment liens and foreclosure rules. HOAs must offer a payment plan before enforcing a lien.

- Arizona: Arizona Revised Statutes, Section 33-1807 outlines lien priority, enforcement, and homeowner rights.

- Washington: Revised Code of Washington, Section 64.34.364 details lien requirements, including notice periods and payment obligations.

- Ohio: Ohio Revised Code, Section 5312.12 defines the scope of HOA liens, assessments, and enforcement rights.

Preventing & Resolving HOA Liens

For Homeowners:

The best way to prevent a lien is to stay current on your HOA fees. Setting up automatic payments or calendar reminders can help ensure you never miss a payment. If you receive a late notice, do not ignore it. Address the issue immediately before it escalates. If you are facing financial difficulties, reach out to your HOA as soon as possible. Many associations offer payment plans or may be willing to negotiate a solution to help you avoid legal action.

If a lien has already been placed, review your HOA’s governing documents, including the CC&Rs, to understand your rights. In some cases, you may be able to dispute the lien if it was filed improperly or includes unauthorized fees. Seeking legal advice or mediation can also be helpful if you are unsure of your options.

For HOAs:

Rather than resorting to immediate legal action, HOAs should first attempt alternative collection methods. Mediation, flexible payment plans, or installment agreements can be more effective than placing a lien right away, especially for homeowners who are willing to cooperate. A clear, well-documented payment policy is essential for avoiding disputes. The HOA’s governing documents should outline the steps taken before a lien is filed, including the required notices and deadlines.

Open communication with homeowners is key to preventing issues before they escalate. HOAs should proactively reach out to members who have fallen behind on payments and provide clear options for resolving the debt. By fostering a cooperative approach, associations can reduce conflicts and minimize the need for legal action while maintaining the financial stability of the community.

The Role of Communication in Avoiding HOA Liens

Poor communication is a major factor in HOA lien disputes. Both homeowners and HOAs can take steps to improve transparency and prevent conflicts.

For Homeowners:

Staying informed and proactive can help avoid misunderstandings. Attend HOA meetings to stay updated on financial decisions, request clear explanations for any fees, and address disputes early to prevent escalation.

For HOAs:

Clear and open communication reduces the risk of unpaid dues turning into liens. Provide homeowners with detailed, written notices outlining payment deadlines, fees, and potential consequences. Using HOA management software like BaseHOA can streamline communication, making it easier to send automated reminders, track payments, and provide homeowners with direct access to important financial information.

By improving communication, both homeowners and HOAs can work together to resolve issues before they lead to legal action.

Managing HOA Liens with BaseHOA

HOA liens can create serious challenges, but a clear understanding of homeowner rights and HOA responsibilities can help prevent unnecessary disputes.

For HOA boards, keeping track of dues, enforcing liens, and maintaining accurate financial records can quickly become overwhelming. BaseHOA simplifies the entire process by helping you manage payments, stay compliant with legal requirements, and improve communication with homeowners.

Unpaid dues should not disrupt your community. Stay organized and in control with BaseHOA. Try it today!