Every homeowners association needs to have clear and precise financial reporting in order to keep the trust between the board and the members. One of the best tools to achieve that transparency is a well-prepared HOA statement.

An HOA statement, also known as a homeowners association financial report, provides a detailed overview of the community’s finances. It shows the collection of funds, the allocation of the expenditures, and the amount of money being set aside for reserves. This transparency in finances enables board members to make decisions based on facts and at the same time, allows the homeowners to monitor the management of their dues.

Moreover, especially when it comes to tax issues, the IRS Form 1120-H Instructions are to be strictly followed by the associations, which dictate the way the HOAs will be reporting their yearly income and expenses and thus the associations are still tied to the tax obligations.

Table of Contents

What Is an HOA Statement?

An HOA statement, also called an accounts receivable statement is a document that gives a clear view of your community’s financial situation. The income from dues and assessments is monitored, expenses for maintenance and operations are listed, and remaining balances or reserves are noted. Such transparency enables the board members as well as the homeowners to witness the management of the money and to assess the HOA’s financial health.

An HOA statement is different from budgets which estimate future income and expenses or audits that check past records for accuracy. An HOA statement indicates the actual financial performance of the community during a specific period. It discloses exactly what happened with all the income and expenses recorded thus giving the board and the homeowners a very sound view of the association’s financial health.

Trust and accountability are the main benefits a dependable HOA statement provides. The Board of Directors of the HOA reviews and approves each report, which means that the money is being handled in a proper way and according to the rules set out in the governing documents. Individual dues, special assessments, and late fees along with other member-level details are often included in many statements, which makes it clear for homeowners what they owe.

Modern-day HOAs mostly send the statements either electronically or via automated systems, making them more accessible and at the same time, cutting the chances of mistakes.

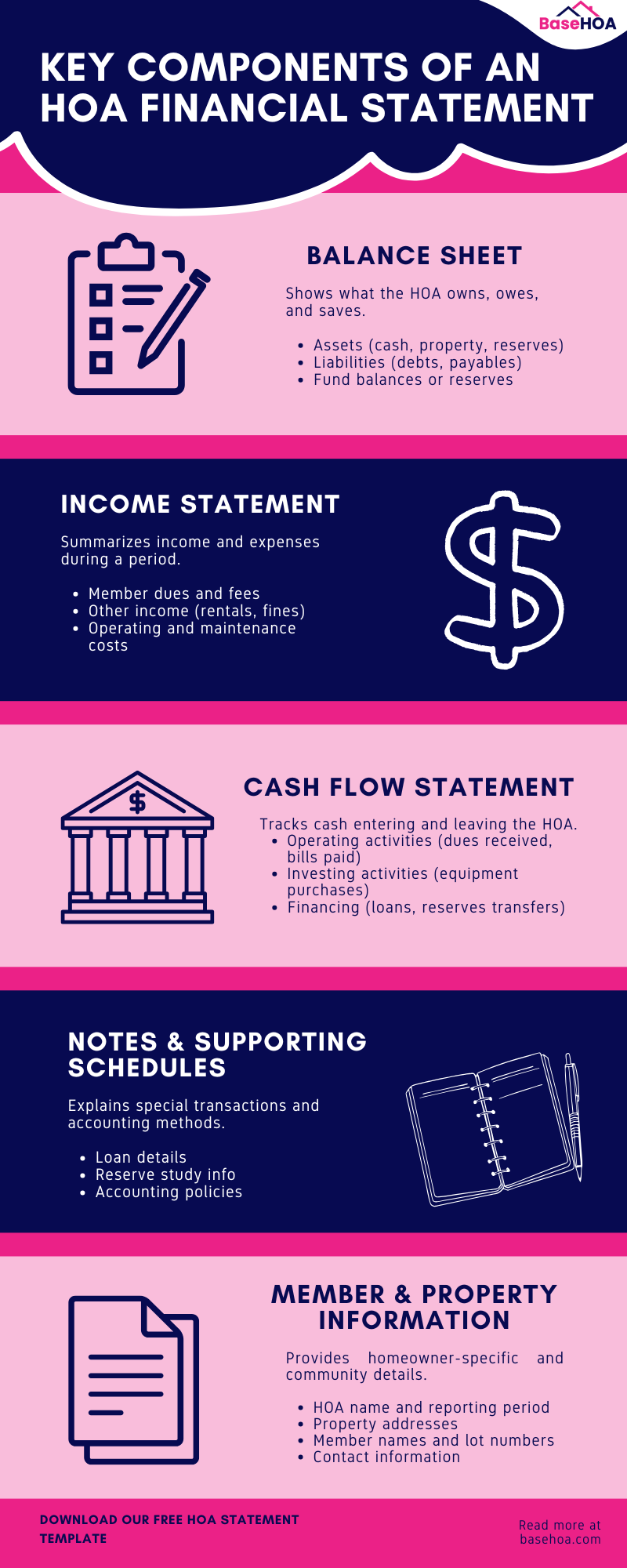

Key Components of an HOA Financial Statement

Every HOA statement has several important parts that show the whole view of the community’s money situation. Knowing every single one makes it so that both the governing body and the residents know the exact ways through which money is acquired, handled, and disbursed, promoting openness and responsibility in the process.

Balance Sheet

The balance sheet shows the HOA’s financial position at a specific time. It indicates the association’s assets, liabilities, and remaining reserves. In general, the balance sheet usually contains:

- Assets: Cash on hand, money in the bank, stocks, and real estate owned by the homeowners’ association

- Liabilities: Unpaid bills, borrowings or money owed to vendors

- Reserves: Cash set aside for upcoming maintenance, repairs, or major projects

The constant review of the HOA balance sheet guarantees that the community has sufficient reserves to deal with emergencies or planned improvements. This part is also vital to knowing the overall financial health of the association.

Income Statement

The income statement, also known as the profit and loss statement, provides a summary of the HOA’s revenue and expenses for a specified period. Key items included are:

- Income from HOA fees and assessments

- Other income: Special assessments, interest earnings, or late fees

- Expenses: Landscaping, maintenance, insurance, utilities, management fees, and other operational costs

A transparent HOA income statement allows the board to monitor the pattern of expenditure, make the right choices regarding the budget, and project the financial requirements of the future. It also informs the community of the various channels through which their dues are going.

Cash Flow Statement

The cash flow statement reports the inflow and outflow of cash in the HOA accounts. This statement is vital for the maintenance of liquidity and the effective running of the business. It usually has:

- Cash inflows: Dues, assessments, rental income, or special contributions

- Cash outflows: Vendor payments, maintenance, reserves funding, or utility bills

- Net cash position: The amount of cash left at the end of the reporting period

Income from special assessments is often included here, since these funds are usually set aside for major repairs or capital improvements.

Notes & Supporting Schedules

This section provides additional context for the main reports and explains specific transactions or unusual items. It typically includes:

- Explanations for large or one-time expenses

- Details about reserve allocations

- Clarification of accounting methods used

- Transaction status, either pending or outstanding

The notes and supporting schedules ensure that the financial statements are fully transparent, allowing homeowners, board members, and auditors to have a clear view of the numbers that back the reports.

What an HOA Statement Includes

Besides the major financial elements mentioned above, a full HOA statement frequently provides details that are practical and focused on the homeowner, such as:

- Names and addresses of the HOA

- Names and addresses of the homeowners

- Date of the statement and the due date for the payment

- Account number

- Total balance and the date of the last payment received

- Breakdown of fees: monthly dues, overdue balances, late fees, vendor credits

- Methods of payment accepted and instructions

If these items are included, the statements will not only be informative but also be actionable. The homeowners will have clear guidance on what is to be paid and how to make the payments, and at the same time, the board will support the transparency in their dealings.

Why HOA Statements Matter

HOA statements are not just keeping a record of the financial transactions. They are important in the aspects of transparency, accountability, and financial security which in turn might be the basis of a stronger relationship between the homeowners and the board.

- Transparency and Accountability: Clear statements display the exact use of dues and help in winning the trust of the homeowners that the funds are being managed responsibly.

- Builds Homeowner Trust: The financial reports that are accurate and easy to get hold of minimize the disagreements and at the same time promote the residents’ participation in the decisions made by the board and the community activities.

- Supports Budgeting and Planning: The board can easily predict the expenses, plan the reserves, and deal with emergencies in a timely manner by means of the up-to-date statements.

- Ensures Compliance: The regular report makes the HOA stick to the rules as per the bylaws and the state law which in turn reflects a well-organized and responsible management style.

How Often Should HOAs Issue Financial Statements?

HOA financial statement issuance frequency can greatly depend on the particular HOA and the regulations of the state it is in. Some HOAs turn out monthly, some quarterly, and some once a year. However, no matter the timing, regular reporting assures proper finances, assists the board in making informed decisions, and keeps the residents aware of the usage of their dues.

Monthly HOA Statements

Many HOAs regularly prepare monthly statements to keep track of their income, expenses, and cash flow. These updates done frequently provide a clear picture of the association’s financial status to the board and, at the same time, make it easier to detect any irregularities early. Monthly reporting is particularly beneficial for larger communities that usually have a lot of transactions or vendor payments.

Quarterly HOA Reports

Some associations prefer to go for quarterly reports instead. This method is quite advantageous to smaller HOAs that do not have so much financial activity. A quarterly cycle still delivers the necessary transparency for budgeting and reserve planning, but it comes with less administrative burden.

Annual Reports

An annual financial statement summing up the whole year’s performance should be prepared by every HOA. This document is typically shown at HOA meetings, where the members of the board and homeowners can talk about the findings, review the financial trends, and budget the next year.

Why Consistency Matters

No matter whether your association has its reports done every month, every quarter, or just once a year, the most important thing is to be consistent. Regular updates not only create trust with the residents but also demonstrate to them that the board is not wasting the money and support the governing documents and the state. Besides, if consistent reporting with transparency is started, then future budgeting will be less difficult and more predictable.

Best Practices for Managing HOA Statements

To manage HOA financial statements effectively, accuracy, organization, and transparency are required. The application of the best practices will ensure that the records are consistent, mistakes minimized, and, the confidence of the homeowners is built.

1. Reconcile accounts regularly

Every month, the bank accounts should, without fail, be reconciled with the HOA’s financial records. This action confirms that every deposit, expense, and reserve transfer is correct. In addition to that, regular reconciliation assists in avoiding mistakes and early detection of problems like double payments or unrecorded transactions.

2. Keep organized digital and paper records

- Implement the practice of storing both electronic and printed copies of the HOA’s financial statements and the supporting documents.

- Organized records make audits and homeowner inquiries easier.

- To support transparency and accountability, keep detailed HOA meeting minutes.

3. Use standardized templates

Using a standard HOA statement template guarantees that all reports will contain the same parts like income, expenses, reserves, and notes. Instead, this method makes the situation clear to the board members and the homeowners.

4. Review and approve statements at board meetings

- During official meetings, each financial statement has to be reviewed.

- Accountability is encouraged this way, and all board members keep informed over the HOA’s financial situation.

- Moreover, it helps in taking informed decisions before going for major expenses or projects.

5. Share summary reports with homeowners

The practice of providing summarized financial updates is a way of keeping open the line of communication and trust. Even a very short version showing the basic figures like income, expenses, and reserve balances is enough for the homeowners to be aware of the management of their dues and not get overburdened with details.

6. Follow state requirements for record-keeping

There are certain states that have put forth certain regulations that deal with HOA transparency and making documents available. A prime example is the Virginia HOA Code: Books & Records Requirements that specifies the mandatory retention and homeowners’ rights to access the financial records.

Checking your state’s regulations would be a good move to secure compliance, and therefore legal protection, for your community.

Automating HOA Financial Statements

HOAs can ease their workload by automating the production of financial statements. At the same time, they can lower the risk of mistakes and enhance the overall process of communication among stakeholders. HOA management software enables boards to create, revise, and distribute statements in digital format, which allows the homeowners to have a live view of their payments, dues, and balances.

The majority of platforms connect seamlessly with the accounting software and bank accounts, performing the whole task of monitoring moneys in and out, reconciling accounts and report generation automatically. The Homeowner’s portals provides residents with the possibility to view the statements and pay online in a very secure way.

Starting from here, the first thing you need to do is:

- Select the HOA software that offers services such as automated statement generation, secure document storage, and e-payments.

- Connect with your bank and accounting service to minimize mistakes and manual data entry.

- Through the software, provide online payment options like ACH and credit cards.

- Determine the frequency of your reporting (monthly, quarterly, or annually) depending on your HOA’s requirements.

Automation will also make the planning of the future much simpler and quicker since it will help boards analyze the financial trends, determine reserves, and prepare future budgets efficiently.

HOA Statement Template

Use our free HOA financial statement template to make your HOA reporting uncomplicated. This template comprises all the essential parts like the balance sheet revealing liabilities, assets, and reserves, income statement, cash flow summary, and several others.

By using this HOA statement template, your records will be kept organized, precise, and professional. Get your HOA financial statement example to simplify the process of reporting and keep the community, in terms of transparency, on your side.

Get Your Free HOA Statement Template Now:

FAQs About HOA Statements

What is included in an HOA statement?

An HOA statement generally displays the association’s revenue from dues and assessments, the operating and maintenance expenses, the amounts in the reserve accounts, and any explanations of unusual items.

Who prepares HOA financial statements?

The treasurer, property manager, or the accounting staff usually prepare the financial statements for the HOA. They then get reviewed and approved by the HOA Board of Directors.

How do you read an HOA balance sheet?

Look at the assets, liabilities, and reserves first. The assets will tell you what the association owns, the liabilities will show what it owes, and the reserves will tell you how much has been saved for future expenses.

How often should HOA statements be reviewed?

The review of the statements should be done as often as the board meetings are held according to your HOA’s schedule. This could be monthly, quarterly, or yearly.

Conclusion

Transparent and regular HOA statements will create trusts and keep the homeowners updated. Reporting with the help of the templates and automation with the software like BaseHOA becomes simple, accurate, and easy to access. If the best practices are followed, then the HOA can manage the money easily while still being open and trustworthy in the community.